As we navigate the evolving landscape of ecommerce, one trend stands out: the meteoric rise of mobile payments. This isn’t just a fleeting trend; it’s a fundamental shift in how consumers interact with online shopping platforms. Especially amongst Millennials and Gen Z, the use of ‘Apple Pay’ and ‘Google Pay’ has become increasingly commonplace.

But with great convenience comes the need for robust security… Let’s take a look at some of the statistics and insights that highlight the significance of this shift.

Mobile Payments: A Numbers Game

The realm of mobile payments is expanding at a breathtaking pace, far beyond local transactions. Take cross-border payments, for instance. These are transactions where the payer and the recipient are based in different countries. They’re vital in our increasingly interconnected world, facilitating everything from international online shopping to remittances sent home by individuals working abroad. Consider this: in 2022, cross-border payment flows surged by 13%. This uptick isn’t just about convenience; it reflects a global embrace of digital commerce.

In Nigeria and Brazil, for example, the shift from cash to digital payments is happening at an extraordinary speed. This rapid adoption isn’t just about ditching physical cash; it’s a broader movement towards embracing digital financial services, which offers greater accessibility, convenience, and often, enhanced security. The embrace of mobile payments in these regions is indicative of a larger global trend towards digitized transactions, where convenience meets global accessibility.

What shoppers really want

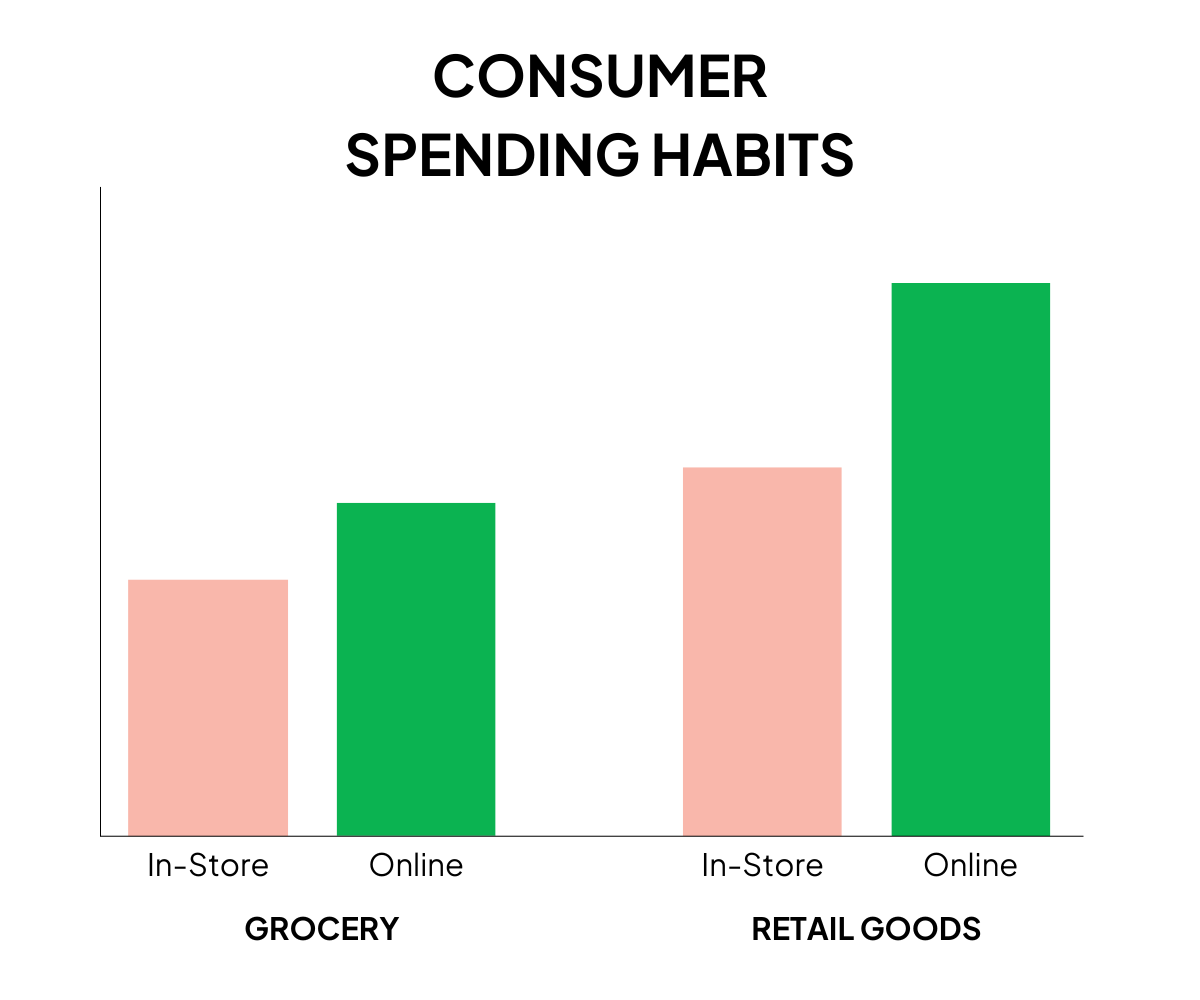

In the digital shopping world, consumer behavior reveals a striking trend: a marked increase in spending when shopping online. Let’s delve into the numbers:

A PYMNTS study discovered that the average online grocery order is about $28 more expensive than its in-store counterpart. But that’s just the tip of the iceberg. When it comes to non-grocery items, the jump is even more pronounced. Consumers shopping online for retail goods such as electronics and apparel spend an average of $42 more per purchase than those buying in-store. This represents a staggering 48% increase in spend.

As shoppers become more accustomed to the ease and flexibility of online purchasing, their spending habits evolve accordingly. This increased spend per transaction in the online sphere underscores the importance for retailers to focus on their e-commerce strategies, especially optimizing the mobile shopping experience to meet these evolving consumer expectations.

A few key items for merchants to optimize their shopping experience:

- Responsive design

- Mobile site loading time

- Simplified checkout (Shopify recently introduced their one-page checkout, indicating the move to easier checkout experiences!)

- Payment flexibility and options

- Accessibility (for example, do you have alt text available?)

- Customer Reviews

The technology behind mobile payments is evolving rapidly. Network tokenization, for instance, is revolutionizing transaction security by replacing sensitive data with unique identifiers. To put this into perspective, Visa has issued over five billion network tokens, a number that eclipses their physical card circulation. This innovation is not just about enhancing security; it’s about ensuring a seamless and user-friendly shopping experience.

BUT, as mobile payments soar, so does the need for stringent security measures. The challenge for businesses is to create a secure transaction environment without compromising the user experience. Implementing technologies like advanced encryption and two-factor authentication is akin to building a digital fortress around each transaction, ensuring that convenience doesn’t come at the cost of security.

Looking ahead in 2024

As we look towards 2024, the e-commerce landscape is set to evolve further. We can anticipate advancements in AI and machine learning to play a significant role in personalizing the shopping experience and enhancing fraud detection. The integration of augmented reality in mobile shopping could also reshape how consumers interact with products online. Additionally, the rise of cryptocurrency as a payment method could introduce new dimensions to mobile commerce security and convenience.

As the e-commerce landscape evolves with the rise of mobile payments, the importance of optimizing the mobile shopping experience becomes increasingly clear. Businesses and consumers are navigating a digital marketplace where convenience, adaptability, and security are paramount.

Securter is at the forefront of this evolution, bridging the gap between in-person and online shopping experiences. Our mission is to make e-commerce transactions as safe as traditional retail. By implementing Securter’s advanced payment security solutions, businesses can provide a secure and seamless mobile commerce experience, mirroring the reliability and trust of in-person transactions.

Stay tuned for more!